Whereas it is fantastic to redeem your factors and miles for journey preparations, reminiscent of lodging and flights, there could be many different bills concerned in planning a visit, reminiscent of automobile leases, practice tickets, fuel and campsite charges. Fortunately, utilizing cash-back rewards together together with your factors and miles can prevent much more cash in your subsequent trip.

With that in thoughts, let’s study the often-overlooked Financial institution of America Most well-liked Rewards® program. On high of the straightforward banking advantages members can anticipate, consolidating your funds with Financial institution of America may enhance your money again earnings with a few of the finest Financial institution of America bank cards.

That is as a result of Financial institution of America designed its Most well-liked Rewards program to incentivize shoppers to maneuver their checking, financial savings, funding and retirement accounts to Financial institution of America and Merrill. The upper your steadiness of whole belongings with the financial institution, the extra perks you’ll be able to unlock, together with with its bank cards. Relying in your holdings and the kind of rewards you are trying to accumulate, it is perhaps time to cease ignoring Financial institution of America Most well-liked Rewards.

Associated: 5 causes to get the Financial institution of America Premium Rewards bank card

Financial institution of America Most well-liked Rewards Program overview

To start out, this is a common overview of this system:

Easy methods to qualify for Financial institution of America’s Most well-liked Rewards Program

To qualify for the Financial institution of America Most well-liked Rewards program, you need to have each of the next:

- An energetic, eligible Financial institution of America checking account

- A 3-month mixed common each day steadiness of $20,000 or extra in qualifying Financial institution of America deposit accounts and/or Merrill funding accounts

There are 5 Most well-liked Rewards tiers. You may qualify for every based mostly in your mixed common each day steadiness:

- Gold: $20,000 or extra in whole belongings

- Platinum: $50,000 or extra in whole belongings

- Platinum Honors: $100,000 or extra in whole belongings

- Diamond: $1,000,000 or extra in whole belongings

- Diamond Honors: $10,000,000 or extra in whole belongings

Each day Publication

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Whereas not exorbitant, even the bottom degree requires some fairly excessive figures. However do not throw within the towel immediately. If in case you have an emergency fund, a vacation account, a financial savings account and a checking account, combining all these balances might qualify you for a Most well-liked Rewards tier. When you add in funding accounts, reminiscent of IRAs, you could even discover that the Platinum or Platinum Honors tiers are inside attain.

Your steadiness would not have to originate with Merrill or Financial institution of America to rely towards every threshold. You may roll present IRAs and funding accounts over to Merrill or Financial institution of America and instantly use these balances to start establishing a three-month common to spice up your tier. After all, you may have to contemplate different issues like account administration charges and out there funding choices to determine whether or not doing so is an effective choice.

Associated: Easy methods to maximize your incomes with the Financial institution of America Premium Rewards card

Easy methods to transfer amongst Most well-liked Rewards tiers

You may rise from one rung to the following any month after your common each day steadiness for the three earlier months reaches the brink for the next tier. When you attain a selected standing degree, you will not have to maintain all of your money within the Financial institution of America basket.

As an alternative, you may keep your Most well-liked Rewards tier standing for a full 12 months. In case you now not meet the qualification necessities after that 12 months, you might have a three-month grace interval to take action. In case you nonetheless do not meet the factors after the three-month grace interval, you may both be moved to a decrease tier or fully lose your Most well-liked Rewards advantages.

Associated: Is the Financial institution of America Premium Rewards Card definitely worth the $95 annual price?

Advantages of Financial institution of America’s Most well-liked Rewards Program

Here is a chart of the 5 Most well-liked Rewards tiers, together with the related advantages of every:

| Profit | Gold | Platinum | Platinum Honors | Diamond | Diamond Honors |

|---|---|---|---|---|---|

| Bank card rewards bonus | 25% | 50% | 75% | 75% | 75% |

| Financial savings rate of interest booster | 5% | 10% | 20% | 20% | 20% |

| Mortgage perks | $200 origination price discount | $400 origination price discount | $600 origination price discount | 0.250% rate of interest discount (when PayPlan is established) | 0.375% rate of interest discount (when PayPlan is established) |

| Auto mortgage rate of interest low cost | 0.25% | 0.35% | 0.50% | 0.50% | 0.50% |

| Dwelling fairness rate of interest low cost | 0.125% | 0.250% | 0.375% | 0.625% | 0.750% |

| No-fee banking companies | Included | Included | Included | Included | Included |

| Free non-Financial institution of America ATM transactions | N/A | 12 per 12 months | Limitless within the U.S. | Limitless within the U.S. and internationally | Limitless within the U.S. and internationally |

| Merrill Guided Investing price low cost | 0.05% | 0.10% | 0.15% | 0.15% | 0.15% |

| International forex alternate price low cost (for cell and on-line orders solely, contains free customary transport) | 1% | 1.5% | 2% | 2% | 2% |

| Entry to unique life-style advantages | N/A | N/A | N/A | Sure | Sure |

Now, let’s take a better have a look at every of those advantages.

Financial savings Curiosity Charge Booster

You might want to have a Financial institution of America Benefit Financial savings account and be an enrolled Most well-liked Rewards member to get pleasure from this profit. If in case you have an present financial savings account, it won’t mechanically convert to a Financial institution of America Benefit Financial savings account whenever you enroll in Most well-liked Rewards. Be sure you request the conversion when becoming a member of Most well-liked Rewards.

At Gold, the rate of interest enhance is 5%. That probably sounds higher than it’s. In case your rate of interest is 1.00%, a 5% price booster would enhance it to 1.05%.

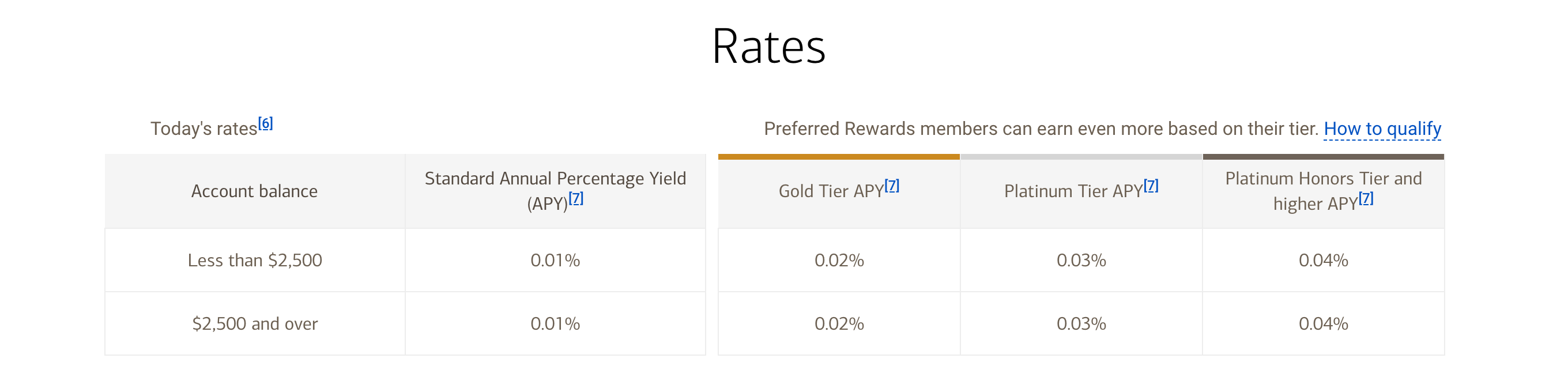

Here is the annual proportion yield on a Financial institution of America Benefit Financial savings account as of January 2025 to present you some perspective:

You may verify how this enhance would have an effect on the present annual proportion yield on a Financial institution of America Benefit Financial savings account in your area right here.

Associated: One of the best methods to economize & earn journey rewards for teenagers

Bank card rewards bonus

Most well-liked Rewards members earn a 25%, 50% or 75% rewards bonus on choose Financial institution of America playing cards. For bank cards that earn factors or money rewards, you’ll obtain a rewards bonus on each buy.

Your incomes price is predicated in your Most well-liked Rewards tier when the acquisition is posted to your account. We’ll get into how this performs out with particular playing cards under.

You may earn the Most well-liked Rewards bonus on most Financial institution of America consumer-branded bank cards, together with the Financial institution of America® Premium Rewards® bank card, the Financial institution of America® Journey Rewards bank card, the Financial institution of America® Limitless Money Rewards bank card and the Financial institution of America® Personalized Money Rewards bank card, amongst others.

Mortgage origination price discount

Any time you’ll be able to lower down on charges for purchasing or refinancing a house, it is best to. Most well-liked Rewards members are eligible to obtain a hard and fast discount in certainly one of two methods, relying in your membership tier:

- A greenback quantity off of your origination price (to not exceed its value)

- A proportion off your mortgage APR

The Most well-liked Rewards price discount is not transferable. And you could not have the ability to mix this price discount with different reductions.

Associated: Bank card methods for mortgage and residential mortgage candidates

Auto mortgage rate of interest low cost

It’s essential to full an auto buy finance or refinancing mortgage by Financial institution of America to qualify for a price low cost. This profit will not be transferable, so solely the Most well-liked Rewards member can make the most of this perk.

After all, you may have to make it possible for Financial institution of America gives essentially the most aggressive price after the low cost. In any other case, it won’t be price pursuing. Even 1 / 4 of a % may save or value you 1000’s of {dollars} over the lifetime of the mortgage.

Associated: What is an effective credit score rating?

Dwelling fairness rate of interest low cost

You may get a house fairness line of credit score rate of interest low cost of as much as 0.75%, relying in your Most well-liked Rewards standing degree.

This profit is non-transferable, however you might be able to mix this perk with different house fairness rate of interest reductions. And even co-borrowers are eligible so long as at the least one applicant is enrolled or eligible to enroll.

Associated: Bank card vs. line of credit score: What is the distinction?

No-fee banking companies

Most well-liked Rewards members additionally get pleasure from a number of banking companies for no price.

These companies embody:

- ATM/Debit card rush charges

- ATM worldwide transaction price

- Month-to-month upkeep charges on as much as 4 eligible checking and 4 financial savings accounts from Financial institution of America

- Non-Financial institution of America ATM charges for withdrawals, transfers or steadiness inquiries

- One overdraft safety switch price waived per billing cycle

Moreover, Platinum and above incur no charges for incoming worldwide wire transfers and might open a small secure deposit field totally free at a Financial institution of America department.

Associated: Easy methods to keep away from ATM charges

Free non-Financial institution of America ATM transactions

Within the U.S. and U.S. territories, Platinum and Platinum Honors members:

- Will not be charged non-Financial institution of America ATM charges

- Will obtain a refund of the ATM operator or community price for withdrawals, steadiness inquiries and steadiness transfers

Platinum members obtain one free transaction per assertion cycle (as much as 12 yearly), and Platinum Honors members haven’t any cap. In the meantime, Diamond and Diamond Honors members have limitless no-fee transactions each within the U.S. and internationally.

Associated: 7 methods to avoid wasting on abroad ATM withdrawals

Merrill Guided Investing price low cost

Most well-liked Rewards members get pleasure from a price low cost when using Merrill Guided Investing companies. You may get began with as little as $1,000 for Merrill Guided Investing or $20,000 for Merrill Guided Investing with an adviser.

Merrill Guided Investing sometimes costs a price of 0.45% of belongings underneath administration, and Merrill Guided Investing with an advisor sometimes costs a price of 0.85% of belongings underneath administration.

Whereas these charges might sound small, they add up over time. As such, these costs can develop into a compound drain in your investments as they enhance. So, it could be finest to search for a monetary advisor that costs a hard and fast price as an alternative of a proportion of your belongings.

Associated: One of the best apps for cash administration

International forex alternate price low cost

All Most well-liked Rewards members will get some type of low cost for international forex orders by on-line banking or the cell banking app.

Relying in your standing tier, you may obtain a reduction between 1% and a couple of%.

Associated: Every part you must find out about international transaction charges

Entry to unique life-style advantages

High-tier Diamond and Diamond Honors members will get pleasure from custom-made and distinctive life-style experiences, reminiscent of journey, wellness, occasions, foods and drinks or different private companies. You may preview a few of these curated gives right here.

Associated: One of the best bank cards out there now

Easy methods to maximize money reward earnings with Financial institution of America bank cards and Most well-liked Rewards

To maximise the Financial institution of America Most well-liked Rewards program, you may wish to qualify for at the least Platinum Honors and be eligible for the 75% bonus in your bank card rewards.

After all, it is not an incredible concept to make massive funding and banking selections based mostly solely on bank card bonuses. Nonetheless, it could be worthwhile in the event you already plan to spend money on Merrill and have an present banking relationship with Financial institution of America. In case you do, listed below are a few of the financial institution’s rewards playing cards to contemplate and how one can maximize your cash-back earnings.

Associated: How to decide on one of the best bank card for you

Financial institution of America Premium Rewards bank card

The Financial institution of America Premium Rewards bank card is a superb rewards bank card in its personal proper. However it will get much more aggressive whenever you add within the bonuses from the Most well-liked Rewards program.

The cardboard costs a $95 annual price and gives a modest number of advantages. For instance, cardholders get an up-to-$100 annual airline incidental price assertion credit score, a World Entry or TSA PreCheck utility price credit score each 4 years (as much as $100) and a few first rate journey protections.

Nonetheless, this card shines with its incomes charges on on a regular basis spending in addition to journey and eating purchases. Here is how the incomes charges stack up when you take into account the Most well-liked Rewards bank card rewards bonus:

| Spending classes | Common cardholder | Most well-liked Rewards Gold (25% bonus) | Most well-liked Rewards Platinum (50% bonus) | Most well-liked Rewards Platinum Honors, Diamond and Diamond Honors (75% bonus) |

|---|---|---|---|---|

| Journey and eating | 2 factors per greenback spent | 2.5 factors per greenback spent | 3 factors per greenback spent | 3.5 factors per greenback spent |

| Every part else | 1.5 factors per greenback spent | 1.875 factors per greenback spent | 2.25 factors per greenback spent | 2.625 factors per greenback spent |

The flexibility to get at the least 2.625% on all purchases with this card (for high-tier Most well-liked Rewards members) is unimaginable. This return makes the Financial institution of America Premium Rewards bank card one of many finest bank cards for on a regular basis spending.

Associated: Financial institution of America Premium Rewards bank card full overview

Financial institution of America Journey Rewards bank card

If you wish to keep away from paying bank card annual charges, you may go for the Financial institution of America Journey Rewards bank card. The cardboard earns 1.5 factors per greenback spent on all purchases. Factors could be redeemed to cowl journey bills at a price of 1 cent per level.

By incomes 1.5 factors per greenback spent on the whole lot plus a 75% Most well-liked Rewards bonus as a Platinum Honors (or larger) Most well-liked Rewards member, you successfully earn 2.625% money rewards towards journey purchases made with the cardboard. That is a unbelievable money reward price to earn on all spending — particularly for a card with no annual price.

Associated: Financial institution of America Journey Rewards card full overview

Financial institution of America Limitless Money Rewards bank card

The Financial institution of America Limitless Money Rewards bank card is nice for people who do not wish to maintain monitor of a number of bonus classes however who nonetheless wish to earn at a powerful fastened price on all their purchases. This no-annual-fee bank card earns limitless 1.5% money rewards on all purchases with no restrict.

Platinum Honors and better members would get again 2.625% on all of your purchases — probably the greatest rewards charges any card gives for nonbonus on a regular basis purchases.

Associated: One of the best Financial institution of America playing cards

Financial institution of America Personalized Money Rewards bank card

One other no-annual-fee card is the Financial institution of America Personalized Money Rewards bank card. It earns 3% in one of many following classes of your selection every calendar month:

- Eating

- Drugstores and pharmacies

- Gasoline and electrical car charging stations

- Dwelling enchancment and furnishings

- On-line purchasing (together with cable, streaming, web and cellphone companies)

- Journey

It additionally earns 2% again at grocery shops and wholesale golf equipment and 1% again on the whole lot else. Simply word which you could solely earn 3% and a couple of% on as much as $2,500 in mixed purchases every quarter (then 1%).

So, in the event you’re at the least a Platinum Honors member, you may earn as much as a whopping 5.25% again in your 3% class. You’d additionally earn as much as 3.5% again at grocery shops and wholesale golf equipment and 1.75% again on all different purchases. That is fairly phenomenal for a no-annual-fee money rewards card.

Associated: Financial institution of America Personalized Money Rewards full overview

Easy methods to convert your Financial institution of America factors to money

A number of Financial institution of America bank cards earn straight-up money. However some earn “factors,” which you’ll commerce for money.

To redeem your Financial institution of America factors with a card such because the Premium Rewards card, you may discover a “money” choice inside your on-line account. This lets you request a press release credit score or a money deposit into your Financial institution of America checking or financial savings account (or eligible Merrill Edge and Merrill Lynch accounts) at a price of 1 cent per level. Observe which you could additionally redeem right into a 529 Faculty Financial savings Plan.

Moreover, the Journey Rewards card earns a barely completely different rewards forex. You may redeem them as a direct deposit into your Financial institution of America checking or financial savings account or as a credit score into an eligible Merrill Money Administration Account — however you may often get a paltry worth of 0.6 cents per level. You may solely obtain a price of 1 cent per level when offsetting a travel-related transaction in your card.

Associated: Easy methods to redeem factors utilizing the Financial institution of America Premium Rewards card

Support authors and subscribe to content

This is premium stuff. Subscribe to read the entire article.